Being an Entrepreneur comes with many challenges and hurdles to overcome.

Unfortunately, one of those prevalent challenges deals with your financial health.

Most entrepreneurs either fall behind with personal finances or neglect them entirely. This can put you in a position where you are burdened by financial stress.

The last thing any entrepreneur like yourself needs is just that; more stress.

While it can be unsettling, it’s the reality. This is what you signed up for.

But just because you’re making daily sacrifices, doesn’t mean that you are not able to make important financial decisions.

In fact, quite the opposite is true. Now is the time to practice and refine good financial habits, and look for ways where you can improve your personal finances so that you don’t feel the financial burden any more than necessary.

Financial fatigue is a real thing that impacts many entrepreneurs, but also something you can improve with some discipline.

Here are 5 ways you can improve your personal finances immediately.

1. Take control of your spending habits

In the early stages of building your company, it’s critical that you exercise complete control over your spending habits. Not just for your business and company related expenses, but for your own personal finances as well.

One of the biggest pitfalls that keeps entrepreneurs and others alike from achieving their financial goals is the lack of a plan in place for their personal spending and savings habits. The absence of structure and discipline in these two areas can end up leaving you in a difficult financial situation.

The root of the problem for most entrepreneurs comes from not tracking where your money outflows. This can be extremely detrimental to your financial plan and can undermine your goals.

Chances are that you track your spending when it comes to your company expenses. Don’t neglect this when it comes to your own personal finances.

If you’re not sure exactly how to get control of this one, start with taking a look at your previous expenses and spending habits. Take a look back and review the last three months of bank statements on everything you’ve purchased (personally) and start writing them down.

Once you have them written down, start categorizing them by expense types so you can better understand the nature of your spending.

Doing this will give you a good indicator and baseline for your first month of budgeting. Again, it’s important to keep in mind that it won’t be perfect. Most likely your budget will require some adjustments along the way.

Just like any exercise, the more you practice this, the easier it becomes. Eventually, you’ll get to a point where this becomes second nature.

There’s a good chance that almost immediately you will notice areas where you are spending way too much. Start cutbacks on those expenses first.. Ideally, you will want to find ways where you can eliminate most of your variable expenses (or the ‘wants’) so that you can focus on saving more and increasing your savings rate.

2. Create (and stick to) a financial plan

Would you navigate your current business without any sort of plan, assumptions, or direction in place? Probably not.

That would only increase your chance of risk and failure.

Yet, most entrepreneurs are managing their personal finances completely blind. In fact, it’s more than just entrepreneurs. Most people are navigating their personal finances without having a proper financial plan in place to guide them.

Having a financial plan is necessary to ensure a successful financial outcome. Your plan is there to help guide your financial decisions with confidence so that you are continually working towards your goals.

There are a lot of reasons why entrepreneurs don’t currently have a financial plan. Traditionally, financial planning has been reserved for wealthy individuals, which excludes many entrepreneurs just getting started. Additionally, financial planning has been known to be a time-consuming process, taking hours, days, and even weeks. This incentivizes entrepreneurs to choose running their business over taking the time to build their financial plan.

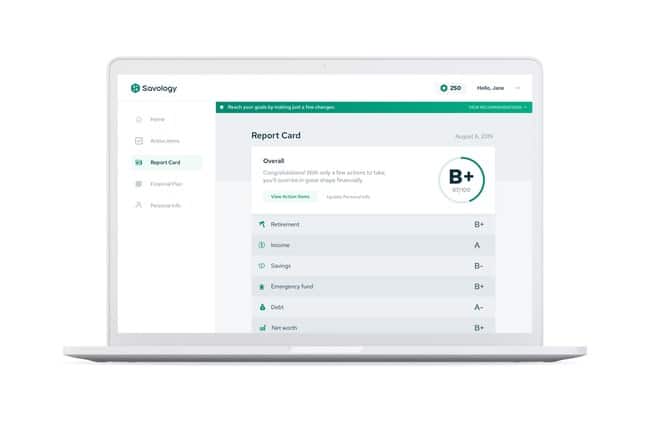

Savology has good news. Now you don’t have to spend hours building a personal finance plan.

Savology, which also happens to be a RevRoad portfolio company, provides free financial planning in just five minutes.

As an entrepreneur, having access to free, accurate, and personal financial planning tools is priceless. That’s why you need Savology.

3. Get an accountability partner

This one can be a real game changer and the additional motivation you need to help keep you focused and stay the course with your financial planning journey.

An accountability partner is exactly what it sounds like. It’s someone who helps you stay accountable to your financial goals.

Typically, this person ends up being a spouse or significant other. However, it can be any individual that you trust. Which means an accountability partner could end up being a close friend, a relative, or even your co-founder. Remember, trust and reliability is the most important thing with an accountability partner.

Trust and reliability are important because you need to be able to share information (and likely details) of what you are working and be comfortable asking for their help to get you there.

If this is something that you’re considering, which we highly recommend setting up regular “check-ins”. This will allow you to have regular conversations about money, so that you can help one another stay motivated, focused, and working toward your goals.

4. Create and consistently review financial goals

Just as you would with your business, creating and reviewing personal financial goals is critical to your success.

The reason is simple. Setting goals is one of the best ways to create clarity around your personal finances, so that you understand what you are working towards and how you will get there.

Remember, when you’re setting goals, don’t just focus on long-term goals. It’s equally important to set both short-term and long-term goals that work together. This is comparable to setting monthly, quarterly and annual goals for your business.

Your long-term financial goals are there to keep you on track holistically, while your short-term financial goals are there to keep you on track day-to-day.. Both should complement one another and play a vital role in the financial decisions you are making.

Lastly, before you move ahead with any type of goals, it’s in your best interest to make sure that you are setting S.M.A.R.T. goals. The acronym stands for:

- Specific (simple, sensible, significant).

- Measurable (meaningful, motivating).

- Achievable (agreed, attainable).

- Relevant (reasonable, realistic and resourced, results-based).

- Time bound (time-based, time limited, time/cost limited, timely, time-sensitive).

5. Diversify your risk by generating new income streams

As an entrepreneur, protecting your income is a financial priority. There’s a good chance that you are not paying yourself market rates, at least not right away, which is why it’s critical that you protect what little income you might be earning.

While it’s important that you are devoting as much of your time and resources to building your company, it’s equally important to make sure that you are not jeopardizing your income and putting yourself in a position where going bankrupt is a possibility.

Because of this, you’ll want to focus on generating new income streams, whether that’s from a side hustle or passive income. This can provide you with earning opportunities that will help you pay your necessary bills, allow you to contribute to your monthly savings, and importantly extend your runway.

By establishing multiple income streams, you’ll be able to diversify and lower your personal financial risk. Ultimately, this gives you more financial resources to build your business.

The concept of this is similar to creating additional revenue streams within your business. By selling through new channels or introducing new products, you create additional opportunities for sales growth. What you are doing is essentially protecting your business against financial risk. If one sales, or revenue, channel underperforms, your business still has a chance of surviving and thriving because of the established revenue and profitability derived from existing channels.

Moving beyond financial fatigue

Financial fatigue is real for the majority of entrepreneurs. But it doesn’t have to be, nor should it be the default option. By using the five tips above, you’ll be well on your way to making steady improvements to your personal finances.

Importantly, it’s critical to focus on building a personal financial plan, before anything else. In just five minutes you can build a free, personal, and accurate financial plan with Savology. Your plan will show you your current financial trajectory and our strengths and weaknesses. That way you can focus on addressing the areas that need attention right away. Build your free financial plan today!